January Commentary

GLOBAL MARKETS

Global markets continued to rally on the back of more dovish central bank rhetoric, softening inflation, and growing optimism for more accommodative monetary policy in 2024.

US MARKETS

Inflation figures drove stock and bond performance

US equities and bonds thrived, boosted by softer inflation figures. The November print for US Core PCE Price Index, the Federal Reserve’s favoured inflation measure, fell to 3.2% from 3.4% in October. The decline opens the door for rate cuts, with ‘real’ rates (Fed Funds minus Core PCE) now over 2%. Within equities, small caps outperformed their larger cap counterparts, while the best performing sectors were Real Estate (+8.0%) and Industrials (+6.9%). Energy was weakest, -0.2%. Domestic fixed income also rallied with longer dated treasuries and corporate issues performing best as yields fell and credit spreads tightened.

Up 4.4% (US 500)

UK MARKETS

Possible rate cuts helping to propel performance

In the UK, investors contemplated an easing of inflationary pressures, and are now pricing central bank rate cuts by the middle of 2024. The risk-on move favoured mid and small-cap stocks relative to the FTSE 100, with the softer dollar a slight net negative for the foreign earnings of many larger cap companies. Despite the economic optimism, energy prices softened a little, with weaker crude price detracting from the performance of oil majors - energy the weakest sector in a broad market rally. Offsetting energy weakness, the materials sector performed strongly as did real estate, industrials, and financials.

Up 4.4% (UK All Share)

EUROPEAN MARKETS

Another strong month of performance

European markets were once again positive in December following on from a strong November. Equities and bonds continued to rally in tandem, with small cap stocks and corporate bond issues performing best respectively. US economic data read-across and a material decline in euro-area headline inflation, from 2.9% to 2.4%, boosted hopes of a more dovish European Central Bank (ECB) and early interest rate cuts to support an increasingly soft European economy, which is threatening to record consecutive, if modest, quarter-on-quarter declines in GDP. The euro remained strong, gaining ground on the greenback and sterling, but declining against a strong yen.

Up 3.9% (Euro 600 Index)

JAPAN MARKETS

Overall flat compared to developed-market peers

In contrast to other developed markets, Japanese indices were flat to marginally lower in yen terms, but positive in sterling, as the yen led global major currencies in the month, rising 4.2% against sterling, and 5.1% against the dollar. Small cap stocks outperformed larger cap companies while growth stocks outperformed value style wise, with the yen’s strength weighing on exporters. Japanese inflation, at 2.8% (Nov ‘23), has begun to ease alongside a contraction in domestic manufacturing. Japanese government bond yields, which had risen less due to yield curve controls, declined less than peers in the month’s global bond rally.

Down -0.4% (Japan Index)

Key Points

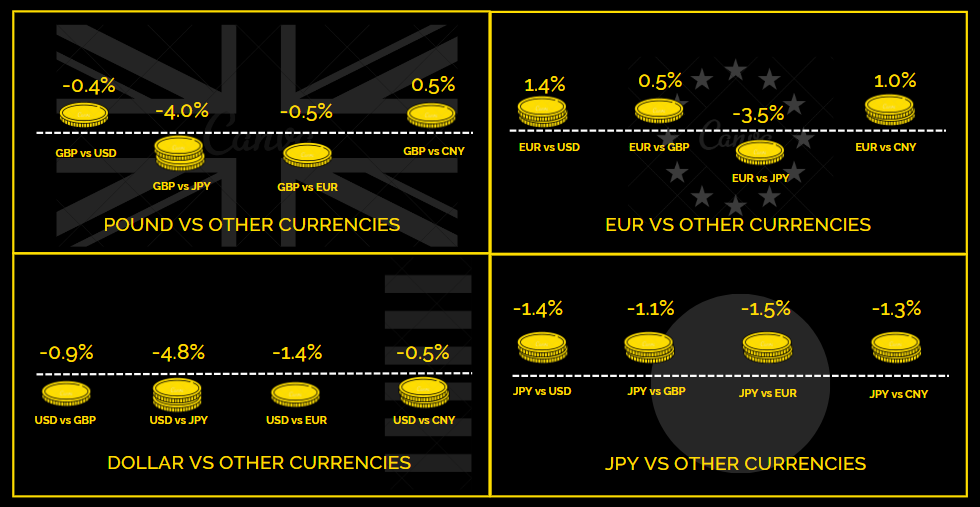

• The best performing major currency in December was the Japanese yen, gaining against the US dollar, and marginally less against the UK Pound, boosted by more modest declines in local bond yields.

• In aggregate terms, sterling had a mixed month, gaining ground against the US dollar and emerging countries alike, but declining against the Japanese yen and the euro.

• Despite soft economic data and declining inflation, the euro performed well rising against the dollar, but closed the month below the best levels, around $1.11.

• The dollar trade weighted index lost around 1% over the month, closing the year trading towards the bottom end of its 2023 range.

· The Swiss franc had a strong month, rising nearly 3% versus the euro, as expectations of future interest rate differentials (with other countries) narrowed, leaving it up over 6% on the year versus the euro.

Key Points

• Moderating inflation, driven by recent falls in goods prices, boosted the markets’ belief that rates have peaked in this cycle. Sentiment was also boosted by the more ‘dovish’ stance from Federal Reserve chairman, Jerome Powell, at his December press conference.

• Interest rates fell across maturities, benefitting the prices of longer dated debt more so than shorter bonds, and supporting optimism within credit, especially high yield, with credit spreads tightening sharply.

• European rates fell more than its US counterparts, UK debt though, led the way. 10-year gilt yields eased 64 basis points, while Italian and Spanish 10-year yields were around 0.5% lower. US 10-year Treasury yields declined a more modest 0.45%.

• Japanese and Swiss 10-year yields fell least among major bond markets, down 0.06% to 0.09%, while Australia and Brazil saw declines of 0.53% and 0.57% respectively.