Steady as She Goes

Does the song title above from the Raconteurs best describes the current state of US Inflation?

Key Points

· The markets want to see US interest rate cuts, to the point where its encouraging, and pricing in, several rounds this year.

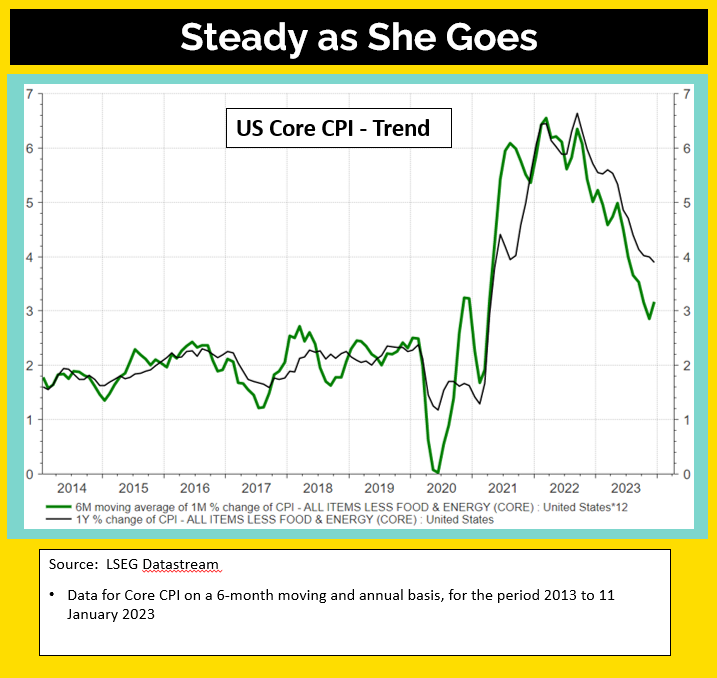

· Yet last Thursday’s US CPI data offered little in the way of support. The data was somewhat hotter than what the markets were expecting, even if the headline rate – Core CPI (what the US Federal Reserve cares about) – was in line with the Fed’s expectations. Dig a little deeper and the inflation data seems quite reasonable. For the 6-month moving average of Core CPI, which may provide a more valuable trend rather than the annual number, was 3.2%.

· Although the inflation battle has stalled somewhat in recent months, and it’s still above the 2% that the Fed would ideally like, there’s some signs of hope in other inflation data – ‘super core CPI’, Food CPI. And while some other areas remain quite persistent (Service CPI, Shelter), the overall inflation picture is looking fine.

· Our views is that it’s not so benign as to scream immediate rate cuts. The economy is still performing nicely – with the well regarded Atlanta Fed GDP now forecasting a robust 2.2% for Q4 23.

· So unless the economy stalls, for now, it’s steady as she goes as far as the Fed is concerned.