September Commentary

GLOBAL MARKETS

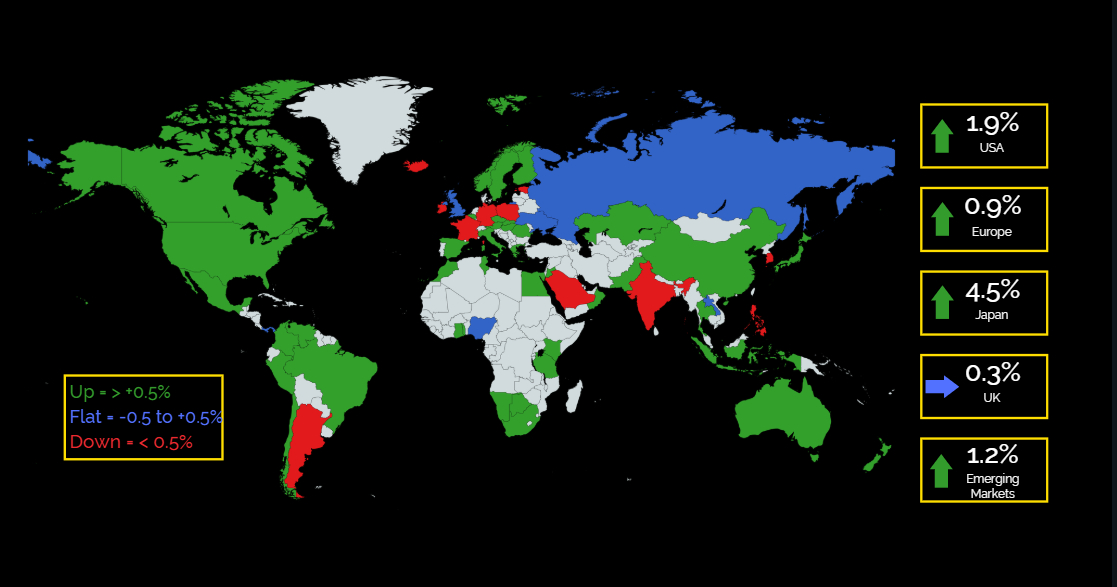

Global markets advanced, buoyed by further progress on trade deals and a positive earnings season. Japan and the US led the way, with Europe and the UK the laggards.

US MARKETS

Equities still hitting all-time highs

US equities rose further in August, with the S&P500 hitting a new all-time high. Small caps were particularly strong, with the Russell 2000 rising 7.0%. It was a resilient performance from the ‘Magnificent Seven’, particularly Alphabet. Investors took comfort from a continued strong earnings season and robust economic data, with the 2nd revision for the 2Q25 GDP pointing to an economy regaining momentum. Gold Miners were particularly strong, with Newmont up 19.8% as investors focused on the improved cash flow outlook for the sector.

Up 1.9% (US 500)

UK MARKETS

Muted returns on upcoming budget uncertainty

UK equities struggled somewhat over the month, with the FTSE100 barely ahead for the month and the FTSE250 in negative territory. Intra month, we did see a new all-time high for the FTSE100 (9,321), before a later month sell-off. Whilst headline data for 2Q25 GDP and government borrowing came in marginally ahead of expectations, the underlying picture for both remains weak. The November budget is coming into focus, with several tax raising suggestions doing the rounds. This sapped investor sentiment further, as did the rise in longer duration gilt yields.

Up 0.3% (UK All Share)

EUROPEAN MARKETS

Mixed results on political risk

European equities saw the return of political risk, with the prospect of a vote of no confidence in the French government. Bond yields also rose as markets became more concerned over French fiscal discipline. This sapped some of the early month strength in European equity markets, with the Stoxx 600 peaking on 22nd August before retreating somewhat. Danish wind farm developer Orsted drew negative headlines, with an emergency fund raising and a major US project suspended just before completion. This double hit saw the shares fall -36% over the month.

Up 0.9% (Euro 600 Index ex UK)

JAPAN MARKETS

Surged ahead on positive news

Japan was the best performing major developed equity market during August, with the Topix index surging 4.5%, reaching a new all-time high. This reflected further investor relief in the wake of the US-Japan trade deal. It was noticeable that value outperformed growth as an investment style, reflecting further positive sentiment for exporters, post the trade deal agreement. Equity markets seem to take the further rise in Japanese bond yields in their stride.

Up 4.5% (Japan Index)

Key Points

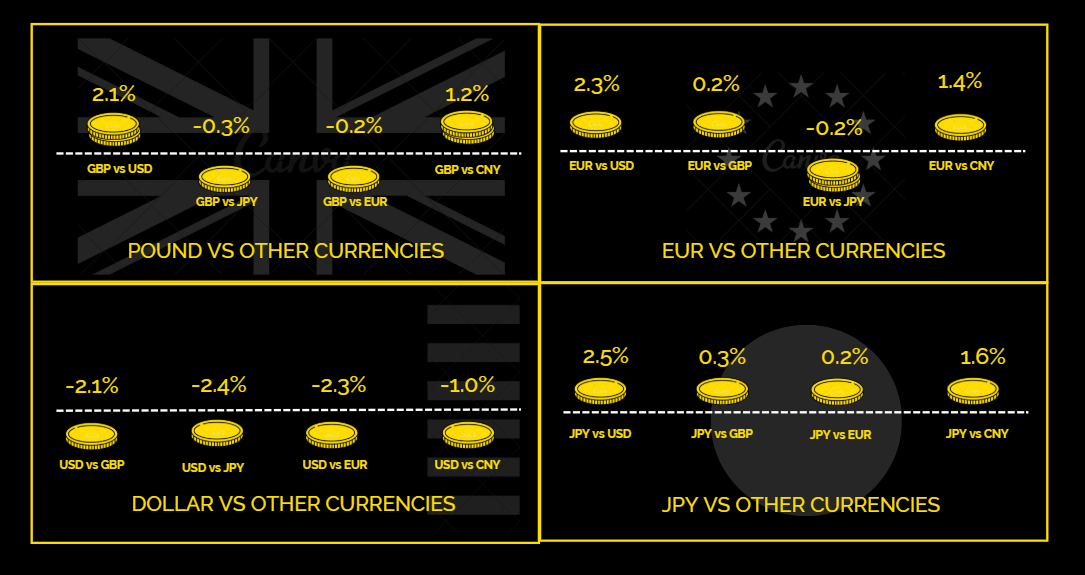

• The US dollar index fell -2.2% over the month and was particularly weak at the start of the month, reacting to a poor Non-Farm Payrolls jobs report.

• Sterling rose against the US dollar, moving up from U$1.323 to close the month at U$1.351. Against both the euro and the yen, it was broadly unchanged.

• The yen strengthened against the weak US dollar, finishing the month at 147 yen. There was minimal movement against either sterling or the euro.

• It was the same story with the euro, strong versus the US dollar, broadly unchanged elsewhere. In Asia, after several months of sustained strength, the Taiwanese dollar was noticeably weak.

Key Points

• Bonds overall were positive for the month, but this masked a huge variance in outcomes across the fixed interest space. High yield, corporate credit, and short duration sovereign were positive, but many long duration sovereign yields rose.

• UK gilts were weak, similar to the previous month. Inflation rose and was worse than expected, causing markets to cut back on rate cut expectations. Concerns over the fiscal situation saw the 30-year gilt yield hit 5.60% at month end, the highest since May 1998.

• Euro government bond yields rose steadily over the month, with French 10-yr yields closing at 3.51%. Political jitters and concerns over the inability of the French government to tackle the large budget deficit unnerved investors.

• US treasuries were caught between two conflicting emotions. Short duration treasury yields fell sharply, as weaker non-farm data offered scope for rate cuts, but 30-year yields reacted badly to mounting tension between the White House and the Federal Reserve.

• High yield and investment-grade corporate credit markets were again positive, particularly high yield. Resilient corporate fundamentals and positive investor sentiment combined to provide a healthy backdrop.