When Cash Isn’t King

Key Points:

· Interest rates have been steadily coming down, with the latest Bank of England cut taking the base rate to 4.00%. Just over a year ago it was at 5.25%.

· Although base rates may be 4%, it doesn’t mean of course that savers will be earning this amount. As banks are in the business of making money, only some level of competition will deliver a rate to consumers which will inevitably be less than this amount.

· At the same time, inflation has been creeping up, with the latest print at 3.6%, and forecasted to be above 4% later on this year.

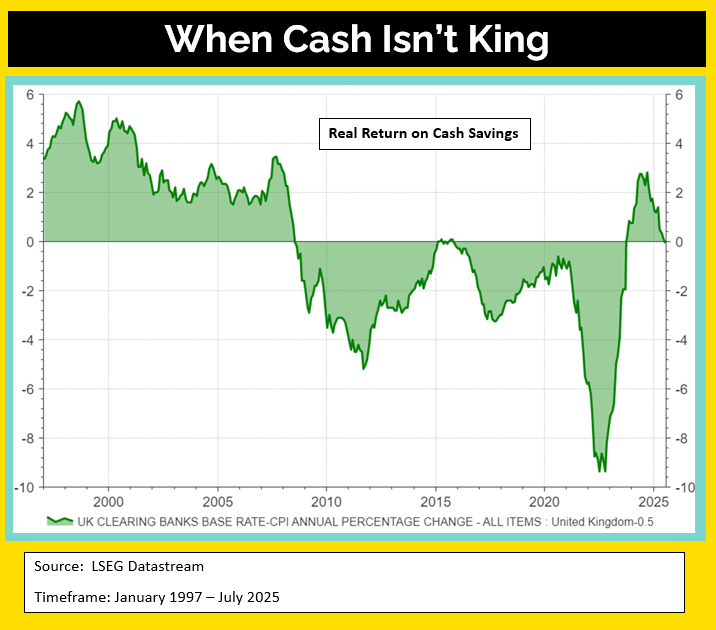

· As the chart shows, if we assume savers are earning on average around 0.5% below base rates for their cash savings, then we are returning to a period where inflation will be above the return on cash savings, i.e. in real terms the cash in your bank, even in a high-interest savings account, will lose you money when adjusted for inflation.

· Prior to the financial crisis, higher economic growth allowed the Bank of England (BoE) to run a restrictive monetary policy, with rates above inflation, giving you a real return on your savings. But weaker structural growth since then has forced the BoE to run a much looser policy. This means that any increase in inflation will quickly erode the real value of cash savings.

· After a brief period of real returns, falling rates and rising inflation will begin again to erode the real value of savings. Real returns will have to come from somewhere else now.