May Commentary

GLOBAL MARKETS

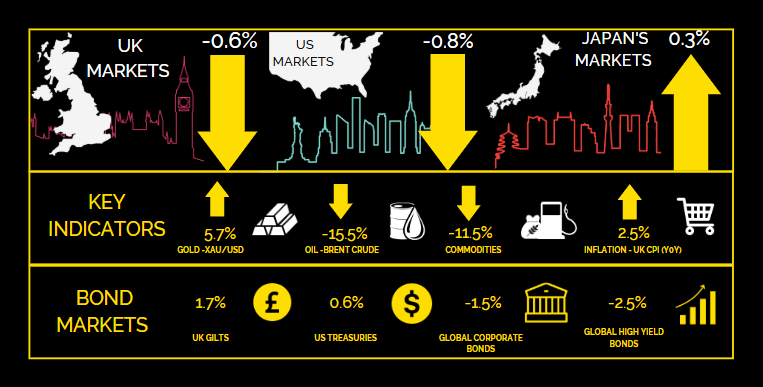

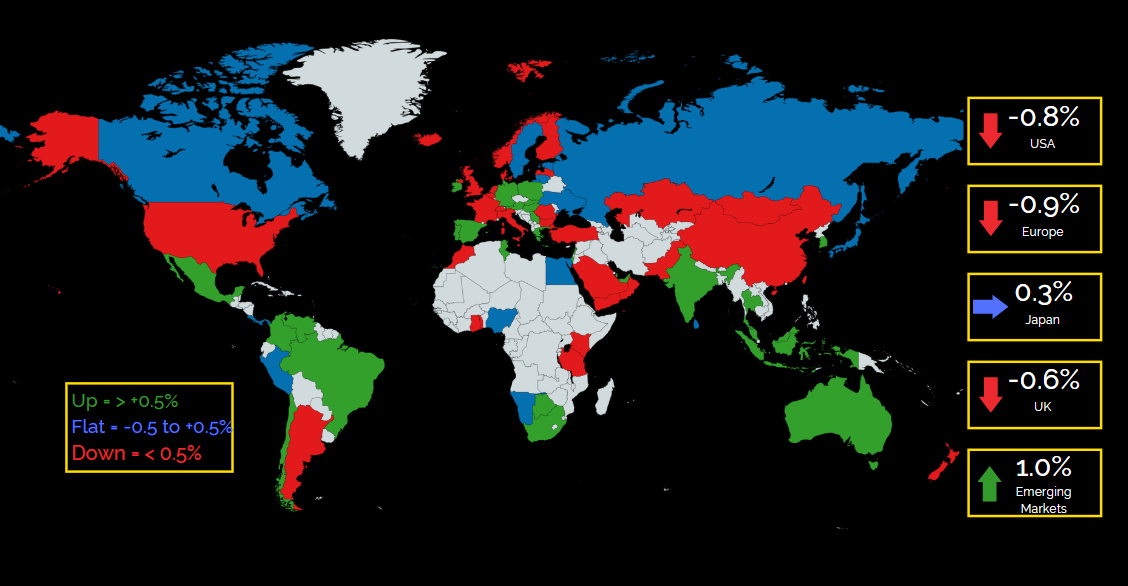

Global markets moved higher in dollar terms but were muted, as US trade policy uncertainty and political pressure on the Fed created headwinds. Developed markets outperformed emerging, while growth stocks outpaced value.

US MARKETS

Tariff uncertainty continued to weigh on US markets

US equities declined, initially falling sharply before rebounding. The Trump administration signalled a potential softening in its trade stance, including a 90-day tariff pause and progress in talks with China, South Korea, and India. The Federal Reserve held interest rates at 4.5%, citing stable conditions but increased uncertainty from trade policy. It revised its growth forecast down to 1.7% and now expects inflation to approach 3%. US GDP contracted by 0.3% in Q1, reversing Q4’s 2.4% growth, as a surge in imports weighed on growth. Microsoft and Meta exceeded earnings expectations, with strong demand for artificial intelligence supporting this performance.

Down -0.8% (US 500)

UK MARKETS

Lower on mixed economic results

UK equities edged lower, although mid and small-cap stocks outperformed. Inflation eased overall, in which Core and Services CPI declined to 3.4% and 4.7%, respectively. Unemployment held at 4.4%, but payrolls fell by 78,467, the sharpest drop since the pandemic. Retail sales rose 0.4% in March, defying forecasts, though consumer confidence weakened in April amid rising energy costs and market volatility. The IMF lowered its 2025 UK growth forecast to 1.1% from 1.6%.

Down -0.6% (UK All Share)

EUROPEAN MARKETS

Lower on tariff uncertainty and weak regional results

European equities declined but recovered some early losses as sentiment improved following the US decision to delay tariff increases and ease trade tensions with China. The ECB cut its deposit rate to 2.25% and maintained a data-dependent stance, noting weaker growth prospects amid trade uncertainty. Germany lowered its 2024 GDP forecast to 0.0%, with the Bundesbank warning of a possible mild recession. Eurozone business activity softened, with the composite PMI falling to 50.1 in April from 50.9, as services weakened slightly while manufacturing expanded for a second month.

Down -0.9% (Euro 600 Index ex UK)

JAPAN MARKETS

Higher on potential trade progress with US

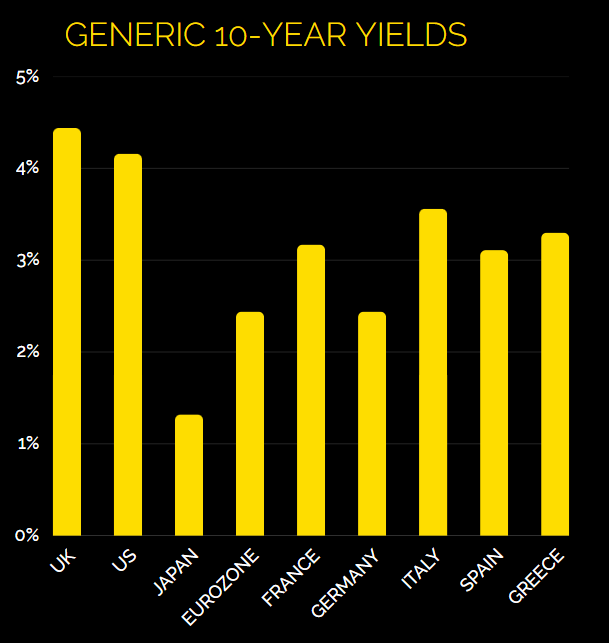

Japanese equities recorded gains, supported by progress in US trade negotiations and the perception of Japan being a safe-haven amid US – China trade tensions. The Bank of Japan maintained a cautious tone, with Governor Ueda signalling potential policy support as needed. This contributed to a decline in the 10-year government bond yield to 1.31%. On the economic front, exports rose 3.9% year-on-year in March, below expectations and sharply lower than February’s growth, due mostly to US tariffs and weaker global demand. Imports increased 2.0%, missing forecasts but marking a return to positive growth after a decline in February.

Up 0.3% (Japan Index)

Key Points

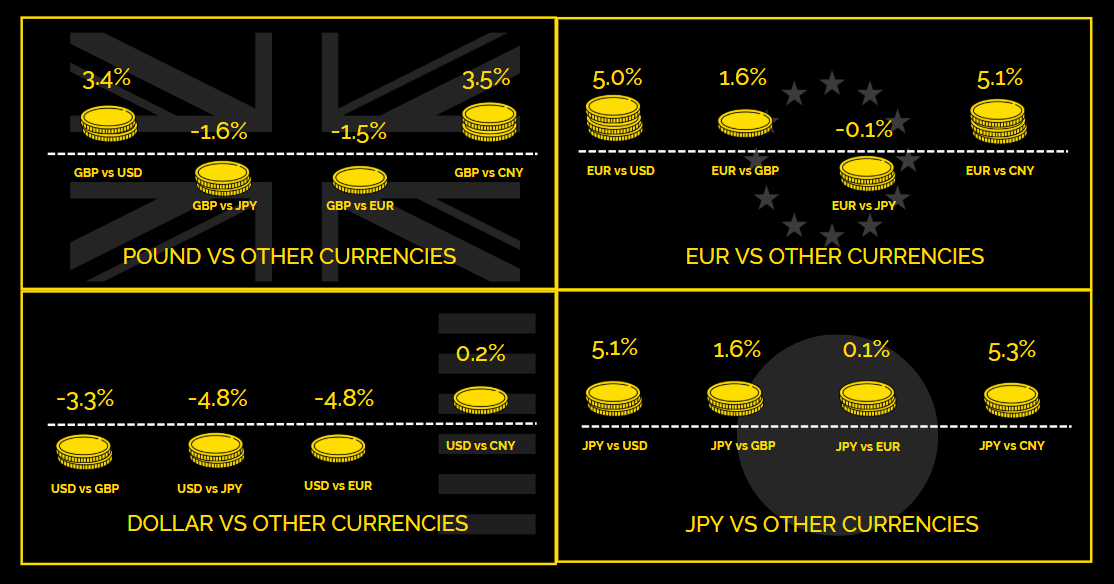

• The US dollar declined as investor confidence in the United States weakened, reflecting concerns about the unpredictability of government policy. The US dollar's traditional status as a safe-haven asset is being reassessed amid ongoing political and fiscal uncertainty.

• The yen strengthened as demand for perceived safe-haven assets increased amid signs of an escalating trade war between the US and China.

• Sterling ended mostly weaker but stabilised on improved global sentiment. A dovish Bank of England stance weighed the currency down, but optimism over trade talks supported the pound.

• The euro strengthened, reflecting a combination of US tariff shocks weakening the dollar, safe-haven demand for the euro, and favourable monetary policy expectations in Europe.

Key Points

• US treasury returns fell in April as yields rose, led by the long end of the market; the selloff was driven more by market ‘technicals’ and positioning rather than fundamentals, with limited evidence of significant foreign selling.

• UK gilts were volatile throughout April but ultimately ended the month higher, driven in part by a sharper-than-expected decline in March inflation data, which reinforced expectations that the Bank of England may begin cutting rates as early as May.

• Eurozone government bonds posted modest gains, supported by resilient economic data and a more constructive policy outlook.

• Credit markets showed resilience, with investment-grade bonds performing well due to strong earnings and improving fundamentals. However, high-yield bonds faced pressure from rising long-term rates and tightening credit conditions affecting leveraged issuers.

• Emerging market debt had mixed performance in April. Weaker foreign demand for US treasuries and a global risk-off sentiment pressured EM bonds, while stability in Latin America and Asia, supported by commodities and fiscal policies, provided some gains.