De-Dollarisation

What will it mean for portfolios?

Key Points:

· April was a volatile month. At its worst, the S&P500 was down -11.2%, despite closing the month barely changed, down -0.9%. In light of all the headlines around ‘Liberation Day’, it was actually March that was the weaker month for US equities (-5.8%), resulting in overall YTD negative returns of -5.5%.

· This has resulted in a typical flight to safety, with gold, long duration sovereigns, and the Swiss Franc all providing positive returns. Yet there is one traditional safe asset missing out on this flight – the US dollar.

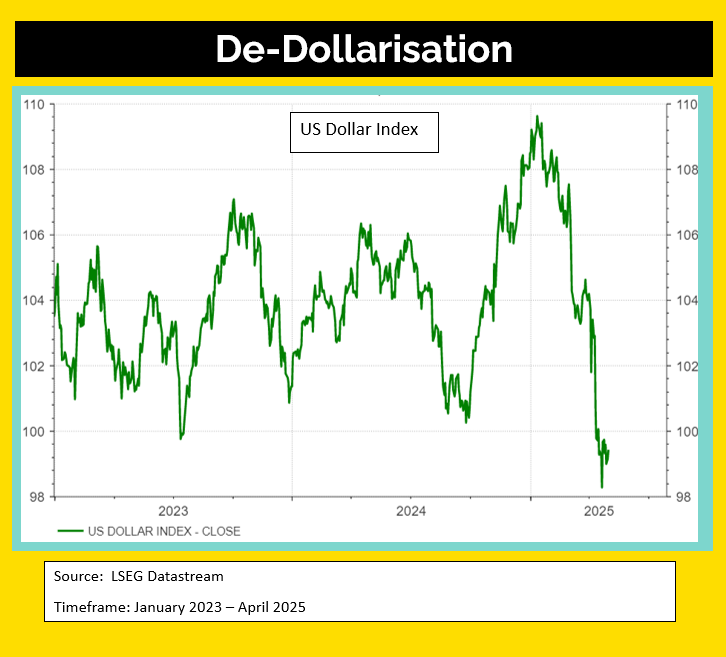

· While the price of gold has soared 26%, the US greenback has lost nearly -8% on a trade weighted basis. For what was traditionally seen as a safe haven, that is a huge move, and a huge move the wrong way. In terms of importance, it has been less about the level that the US dollar has fallen and more about the speed and scale of that movement.

· At the same time, we have also seen a flight to safety in long duration sovereign debt, with European 30yr yields dropping between -11bps and -14bps since President Trump’s tariff announcement on April 2nd. By contrast, US 30yr yields have risen +10bps – another US dollar based safe haven acting rather strangely.

· Put the two together – US dollar returns and 30yr treasury yields – and you have the signs of ‘De-dollarisation’ (a shift away from dollar based perceived safe havens), and this may be the real contributing factor to recent market movements.