February Commentary

GLOBAL MARKETS

The dominant theme remains the timing of anticipated rate cuts, which is causing significant fluctuations in global stock, bond, and currency markets.

US MARKETS

Markets continue to remain resilient

The US stock market displayed resilience amid positive economic data. The S&P500 rose, with growth, technology, and large-cap, equities outperforming their value and small-cap counterparts. Inflation data continue to improve, particularly the Fed’s preferred PCE Core inflation measure. However stronger economic data, such as retail sales and the first estimate for 4th Quarter 2023 GDP, pushed back the expected start of any rate cuts. Employment also remained robust. Oil prices surged due to escalating Middle East tensions, impacting global markets.

Up 1.6% (US 500)

UK MARKETS

Weak performance as a result of inflation data

The UK market saw negative returns on the back of December Core CPI inflation (+5.1%) coming in way ahead of expectations, dampening any hopes for interest rate cuts from the Bank of England. This sapped some of the euphoria that we saw the previous month, particularly in the more interest rate sensitive sectors. Mining, oil, and banks all underperformed a weak overall UK market, as global sector sentiment (positive technology, negative global cyclicals) proved an additional headwind. Miners were particularly weak as investors reacted to negative news from China, and on electric vehicle sales.

Down -1.4% (UK All Share)

EUROPEAN MARKETS

Investors looked beyond the weak economic outlook

The euro fell to a six-week low, influenced by the European Central Bank's dovish stance and expectations for interest rate cuts. The STOXX 50 and STOXX 600 indices reached new peaks, driven by cooling inflation indicators and the anticipation of interest rate cuts by major central banks. Investors seemed to be able to look through the weak economic outlook of – 1) PMI data indicating a contraction in Eurozone factory and private sector activity, and 2) Germany facing a number of headwinds as the surge in energy prices in 2022 works its way through its economy.

Up 1.6% (Euro 600 Index)

JAPAN MARKETS

Strong market performance overall

Japan's stock market reached a 33-year high, driven by the Bank of Japan's unchanged interest rate policy and a cut in its inflation forecast for 2024. The Japanese yen experienced fluctuations due to investor sentiment, domestic inflation rates, and expectations around the Bank of Japan's monetary policy. Despite inflation running above its target for a significant period, the Bank of Japan has maintained its ultra-loose monetary policy. In local currency terms, the Nikkei 225 rose 8.43% during the month. Unique amongst major developed markets, value outperformed growth.

Up 7.8% (Japan Index)

Key Points

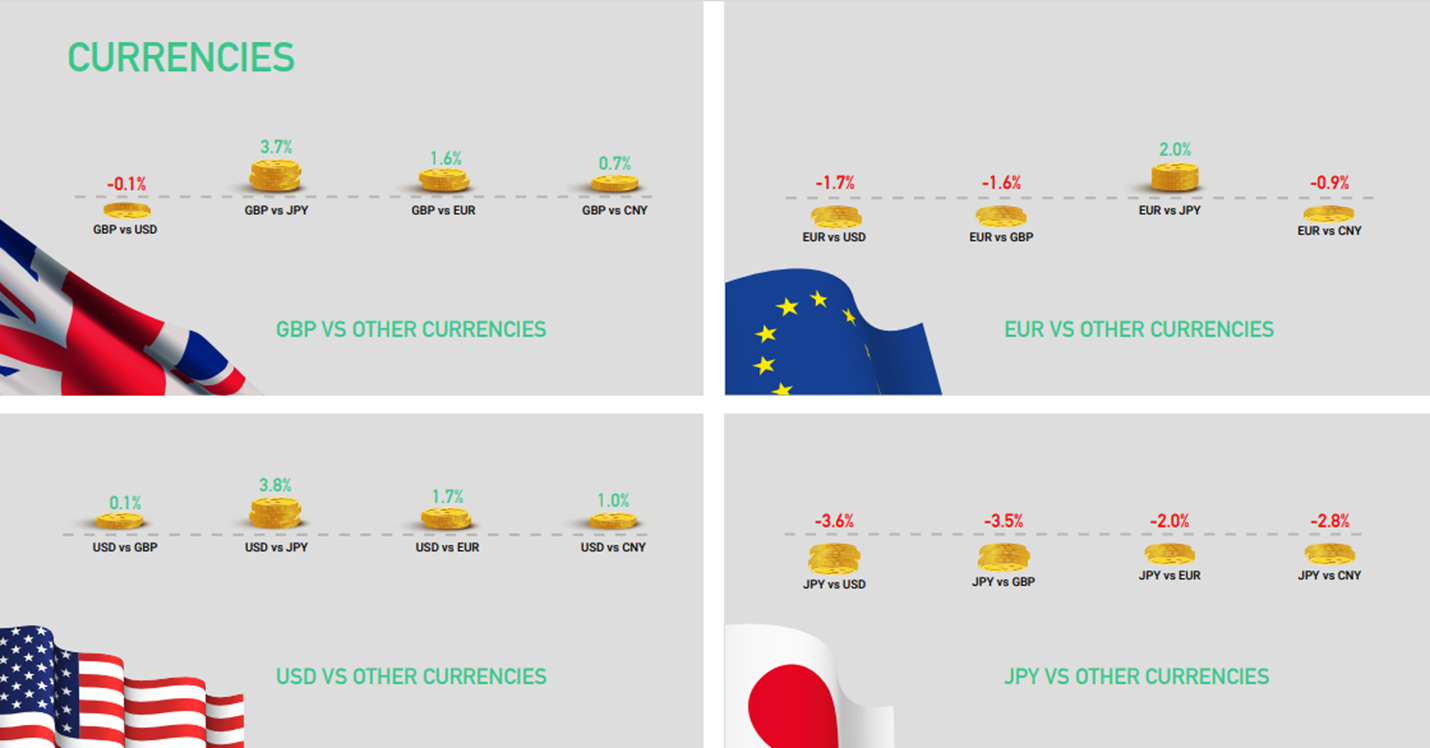

• Sterling ended the month broadly unchanged versus the US dollar, but saw strength against the yen and euro.

• Strong economic data and heightened global tensions saw the US dollar recover much of the ground it had lost in December.

• In Japan, the yen has weakened on the perception that the Bank of Japan will continue to be more dovish towards inflation than most other western central banks.

• In the Eurozone, the European Central Bank (ECB) is expected to trim borrowing costs at a slower pace than the Federal Reserve, despite efforts from ECB policymakers to adopt a more hawkish stance.

Key Points

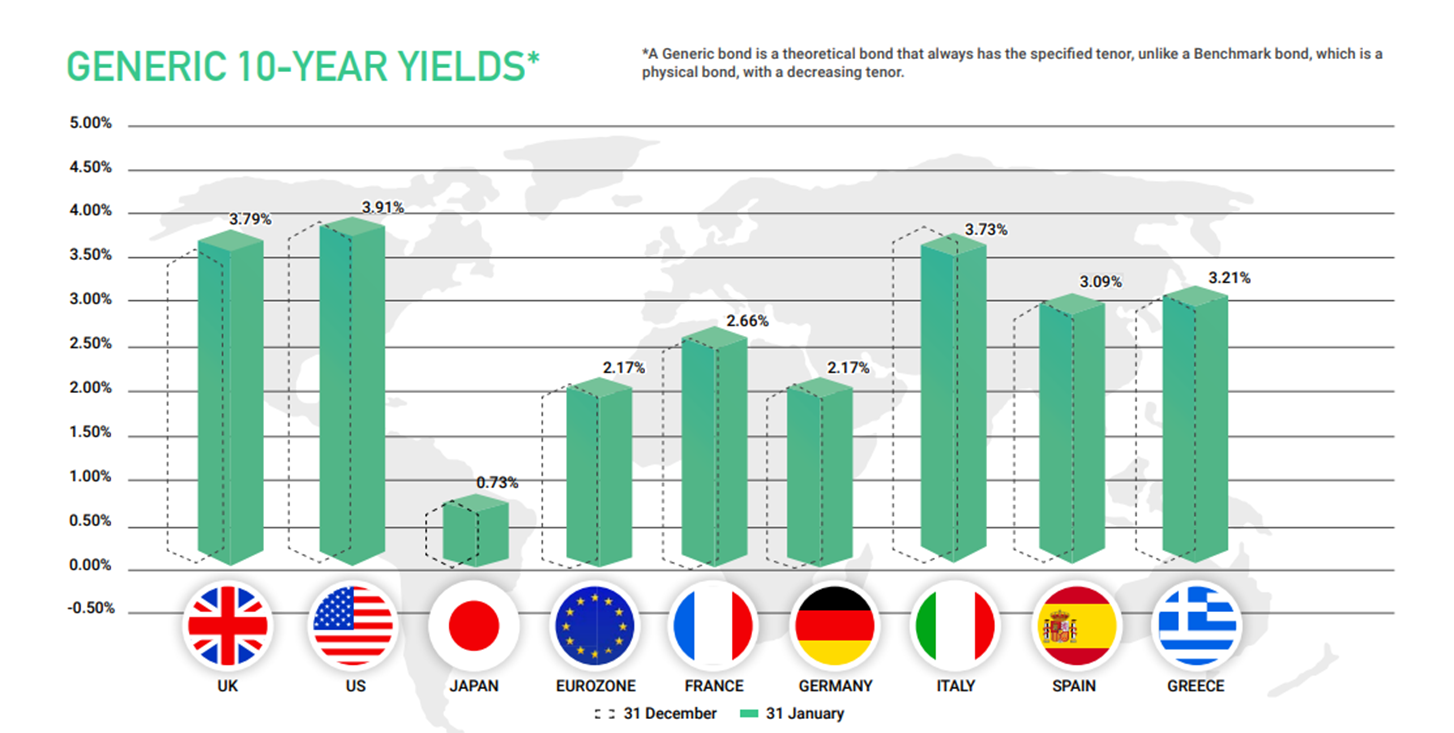

• Global bond markets remain driven by any perceived changes in the short-term interest rate outlook. Investors remain focused on the ‘language’ central banks use in response to the latest inflation data.

• In the US, due to signs of slowing inflation and manufacturing weakness, there was a growing market consensus that there might be a possible series of rate cuts. However, the timing and extent of these cuts remains uncertain, contributing to market volatility. Overall market sentiment seems to be, conversely, vulnerable to any evidence of a robust economy.

• Gilt yields rose in response to poor December Core CPI inflation data. Investors became less convinced of the prospects for a March 2024 rate cut, with UK 10yr yields rising.

• Bond returns were negative over the month, particularly for UK gilts and index linked, with global high yield one of the few fixed-interest areas to post a positive return.