November Commentary

GLOBAL MARKETS

Equities and bond prices both fell as bond yields rose sharply on the back of persistent inflation data. Gold and natural gas rose due to the conflict in the Middle East. Sterling gained against the yen.

US MARKETS

Declined on the back of poor cyclical sector performance

The US equity market declined through October, led by cyclical sectors, with real estate and consumer discretionary stocks being the chief underperformers. The traditional defensive sectors, such as utilities and consumer staples, were the best performers. Despite facing multiple headwinds – including a strong domestic currency and surging treasury yields – and concerns over ‘higher for longer’ interest rates, the US market is proving to be robust and resilient given the release of strong Q3 GDP figures, robust retail sales, solid industrial production, and strong housing starts data.

Down -2.2% (US 500)

UK MARKETS

Strong energy stock performance could not curtail overall weak results

In spite of surging natural gas and gold prices contributing to strong performances from energy-related stocks, which the UK has a meaningful exposure to, the UK markets declined overall. In terms of exposure, largecap stocks outperformed small-cap stocks, and growth stocks outperformed value ones. With the overall financial ‘health’ of the UK consumer remaining a concern on the back of a drop in consumer confidence and house price worries, gilts continued to sell-off and most sectors, including the banks, delivered weak performance.

Down -4.2% (UK All Share)

EUROPEAN MARKETS

Resilient inflation and weak economic data weighed on the markets

Even though the safe haven sectors of utilities and consumer staples gained, and the energy and technology sectors proved resilient, European equities declined overall. Despite recessionary fears and the Eurozone’s manufacturing sector remaining in contractionary territory, with inflation still above its 2% target the European Central Bank (ECB) has maintained its hawkish stance. However, interest rates were left unchanged for the first time in more than a year, in light of evidence of economic deterioration within the region. Government bonds broadly gained as yields receded, while corporate issues traded lower as the economic landscape softened.

Down -3.5% (Euro 600 Index)

JAPAN MARKETS

Growing economic uncertainty led to market declines

While both the TOPIX and Nikkei 225 fell, small-cap stocks managed to outperform large-cap stocks, and growth outperformed value stocks in relative terms. The rise in long-term yields favoured banks, while energy stocks also rose. The Bank of Japan intervened to bring down yields, although the 10-year JGB remained stubbornly high at 0.95%. Growing uncertainty on the outlook for Japan was highlighted by factory activity shrinking for the fifth straight month, while the service sector saw its weakest growth this year. Flash PMI numbers continued to stay below 50, too. The Bank of Japan continued to stick to a dovish message regarding inflation policy.

Down -3.0% (Japan Index)

Key Points

• The US dollar rose again on the back of a stronger than expected US economy in Q3.

• Sterling weakened against the US dollar and euro, with a strong US economy weighing on investors’ minds. While the Bank of England kept rates on hold, fears of an impending recession also drove sterling down.

• The yen weakened against the dollar as US yields rose, putting pressure on the Bank of Japan (BoJ), who decided to further adjust its yield curve control policy, letting the 10-year JGB yield rise close to 1%.

• Within Emerging Markets, Turkey was a large under performer as its currency weakened against the dollar. Turkey’s central bank continues to tighten, raising the policy rate to 35% with inflation above 60%.

Key Points

• Short-dated bonds again proved the best place to be invested as longer dated bond markets struggled in the wake of rising US yields.

• Inflation-linked gilts struggled as 20 and 30-year UK yields moved above 5% intra-month, despite CPI plateauing and core CPI readings falling to 6.1% year-on-year.

• Broad credit markets fell for the month as yields rose and spreads widened but with differing returns among maturity profiles. Sterling short-dated credit gained compared to negative returns for broader investment grade and high yield markets.

• Conventional gilts were down, albeit less so than corporate, high yield and global government (GBP hedged).

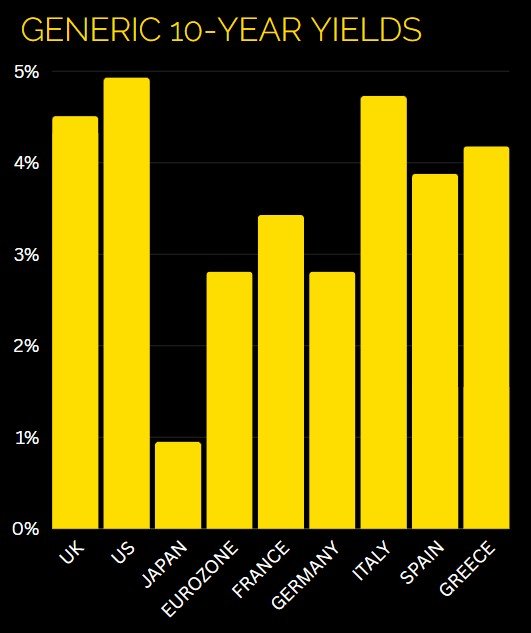

• European bonds outperformed other developed bond markets, with German, Spanish and Italian 10- year bond yields all falling slightly over the month.