October Commentary

GLOBAL MARKETS

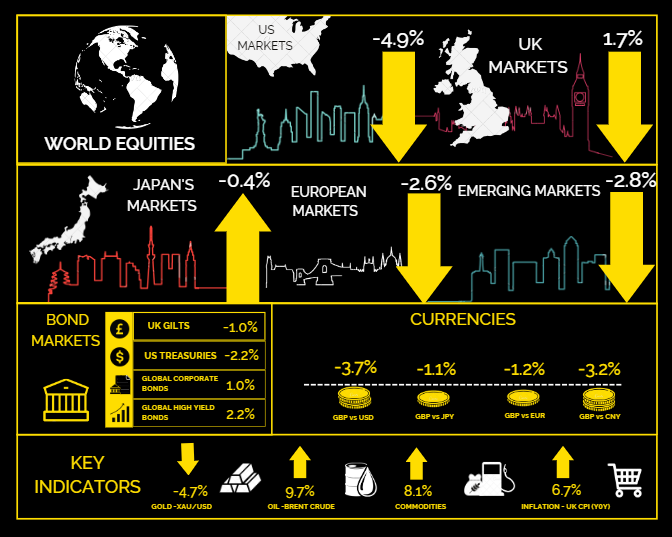

Equities were weaker except for energy stocks, which were buoyed by rising oil prices. Bonds were mixed, with shorter maturities faring better, while longer bonds declined.

US MARKETS

Markets down overall, with the exception being in the Energy sector

The US market saw a meaningful reversion in local currency terms through September. Headline market performance would have been worse if not for the energy sector rallying, owing mainly to sharp rises in the price of oil on the back of demand/supply dynamics. Real Estate, Technology and IT were all particularly weak. Continued softening inflation numbers could have been a positive, but with energy prices strong and Fed rhetoric hawkish, the market feared the implications. Bonds sold off, especially longer dated government debt, challenging growth stocks with higher discount rates. The Fed’s stance buoyed the dollar against most major peers.

Down -4.9% (US 500)

UK MARKETS

Solid performance on the back of large cap selections and higher oil prices

UK equities performed well in sterling terms, owing to the macroeconomic backdrop; dollar feed-through on larger cap selections and higher oil prices being the key drivers of index performance. The underlying benefit to energy companies saw BP and Shell, up circa 8%, lead the market. Natural Resources and Financials fared well too, all boosting the FTSE 100. The mid-cap FTSE 250, which has more domestic earnings, was modestly lower, while small-cap stocks had a stronger second half of the month, boosted by the better inflation data. Index Linked Gilts lagged, as inflation data surprised to the downside.

Up 1.7% (UK All Share)

EUROPEAN MARKETS

Further interest rate increases weighed on the markets

European equities struggled under the threat of further interest rate increases, despite softer inflation and economic data. In line with other major equity markets, the best performers were large cap focused and more Value-biased in style. Macro data was particularly soft in Germany, with falling Retail Sales and business surveys pointing to a recession. Bonds were impacted by the threat of higher budget deficits in the year ahead, particularly in Italy and France. The euro continued to depreciate against the US dollar, and toward the end of the month it reached its lowest point since mid-March, trade weighted.

Down -2.6% (Euro 600 Index)

JAPAN MARKETS

Down overall on macroeconomic backdrop

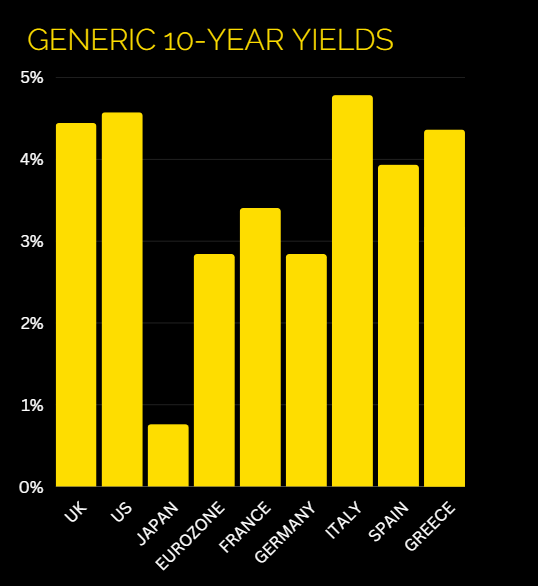

The Japanese stock market was negative for the month in local currency terms. The relative performance of Value versus Growth was particularly strong, and large cap stocks outperformed smaller cap selections. The Bank of Japan’s (BOJ) decision to loosen its grip on interest rates, allowing the 10-year Japanese government bond yield to rise above the 0.5% upper limit, was a surprise move that spurred bets of further policy normalization. Inflation has reached target levels, with the latest CPI print at 3.2% for August.

Down -0.4% (Japan Index)

Key Points

• The US dollar led currency markets, with the dollar trade weighted index hitting its highest level this year, which aided returns from sterling investors perspective. Commodity-linked currencies such as the Canadian and Australian dollars also performed well through the month.

• Sterling weakened as expectations grew that the peak in base rates has been seen, with the Bank of England narrowly voting in favour of pausing tightening, and inflation surprising to the downside.

• The Yen again weakened against the dollar. Despite the talk of an end to Japanese yield curve control, Japanese interest rates look set to remain lower than developed market peers for some time.

• The Swiss Franc, usually a beneficiary of ‘risk-off’, lagged as the Swiss National Bank surprised investors by keeping interest rates unchanged for the first time since March 2022, at 1.75%.

Key Points

• With duration heavy selections declining, Short-dated bonds again proved the best place to be invested in the sector on balance.

• In the UK, Inflation Linked Gilts struggled as long dated interest rates moved higher and inflation softened on the most recent print.

• Credit (hedged) was weaker for the first time in a while, with the Barclays Global Aggregate High Yield (GBP hedged) lower on the month, if slightly less so than longer maturity global corporate and global government bond benchmarks.

• In reaction to the UK inflation prints surprising to the downside, conventional gilts outperformed peer government bond markets for the first time in a while.

• Italian Government Bonds bore the brunt of selling in Europe, with 10-year yields rising more than 0.66% month-on-month. 10-year US Treasury yields rose only marginally less, up 0.46%.