Compounding – “The most powerful force in the universe.”

So just what is compound interest?

You may already be familiar with the concept of earning interest such as through your bank account. You put in £1000, the bank pays you say 2% per year and at the end of the year you’ve earned £20.

It doesn’t sound much I know. However, compound interest refers to the interest you then earn on that £20, so you have earned interest on your interest. This means even if you didn’t put more money into the bank, the amount you earn increases each year.

The beauty of compounding is that your money continues to grow at an increasing pace, it may not sound like much but over time and with increasing deposits or big enough numbers, compounding delivers powerful results.

How compounding can boost your growth

Compounding accelerates your money’s growth so long as you don’t withdraw your interest. In your bank account, you simply leave the interest in there to continue to grow. In an investment portfolio, any interest earned in the form of dividends for example should be reinvested back into the portfolio to benefit from the effects of compounding, this is what we do here at Spring IM. There are additional ways that can turbocharge your compounding which are:

- A higher interest rate or rate of return – that’s our job!

- A bigger starting sum of money

- More time to grow

What does this look like in numbers?

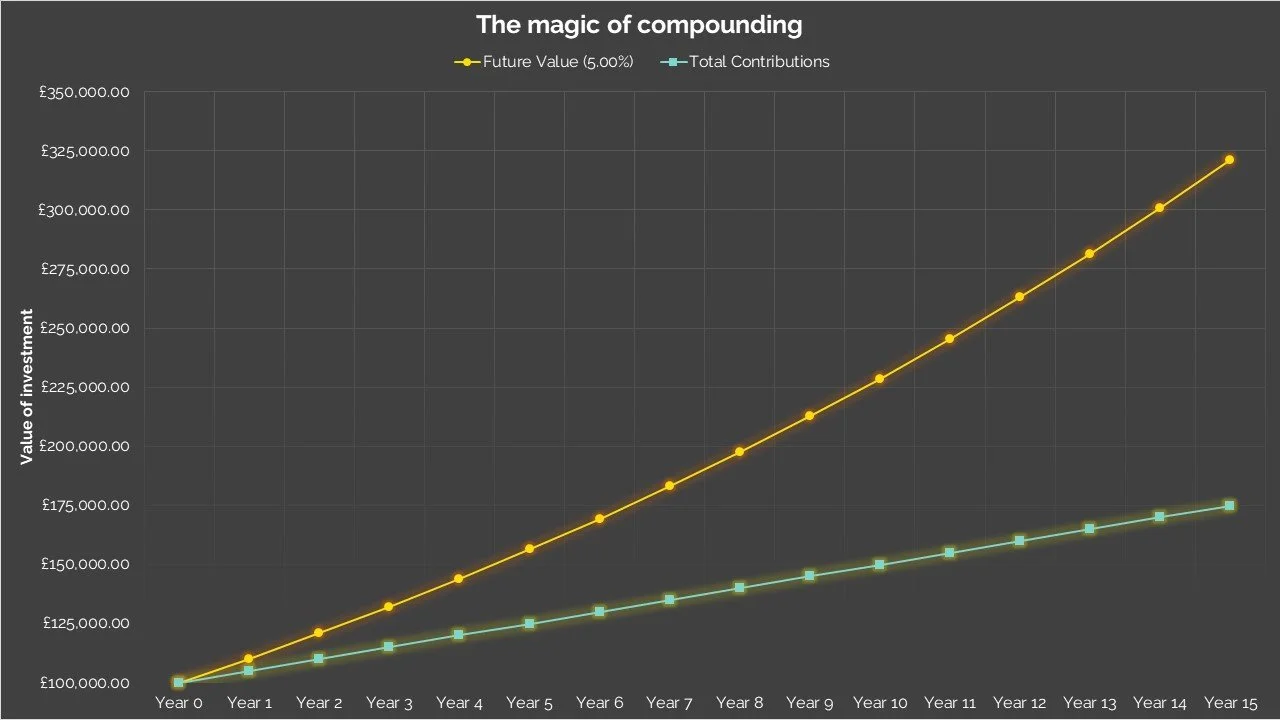

Imagine if you started with £100k and were to let your money grow for 15 years, and in addition you were able to invest an additional £5k per year. What would this look like if you were to achieve 5% per year?

With enough time, a steady rate of return and the ability to add to your pot, you can see just what a difference compounding can make to your total contributions. Putting your money in a savings account will compound your money, but with interest rates so low people look towards investments that pay more over the long run – even a slightly higher interest rate can boost your money’s growth by considerable amounts.

To sum up

Compound interest refers to earning interest on the interest you’ve already earned. You can boost the compounded growth of your money by saving more, letting your money grow for longer, and seeking higher rates of return by investing your money in an investment portfolio instead of the low rates offered by a savings account.