Preservation Portfolios

Which portfolio is right for me?

-

Defensive

A low-risk strategy with the aim of achieving some capital growth over the short to medium term with below average volatility.

To view our performance, why not find out more…

-

Balanced

A moderate risk strategy seeking to protect clients from inflation with the aim of achieving medium to long term capital growth.

To view our performance, why not find out more…

-

Growth

A moderate to high risk strategy with the aim of maximising total return over the longer term, targeting capital growth with some capital protection.

To view our performance, why not find out more…

Our portfolios are:

-

Available in multiple currencies.

Select the base currency of your globally diversified portfolio in GBP, USD or EUR.

-

Automatically rebalanced with dividends reinvested.

We use investment platforms to trade and provide custody of your assets. Your portfolio is automatically rebalanced with your dividends reinvested, earning you more.

-

Integrated with Environmental, Social & Governance principles.

All assets have gone through a rigorous selection process reviewing environmental, social and governance (ESG) factors at the early stages of fund selection.

-

Benchmark agnostic

We are unconstrained in our approach. We do not hug arbitrary benchmarks or allocate assets in pre-determined proportions based on outdated, rigid practises. Our portfolios are developed through a rules-based, global multi-asset approach.

How do we construct our Preservation portfolios?

Our unconstrained, globally diversified portfolios are built around a central capital preservation core, while our ‘satellites’ look to capture growth through developed market equity and global trends.

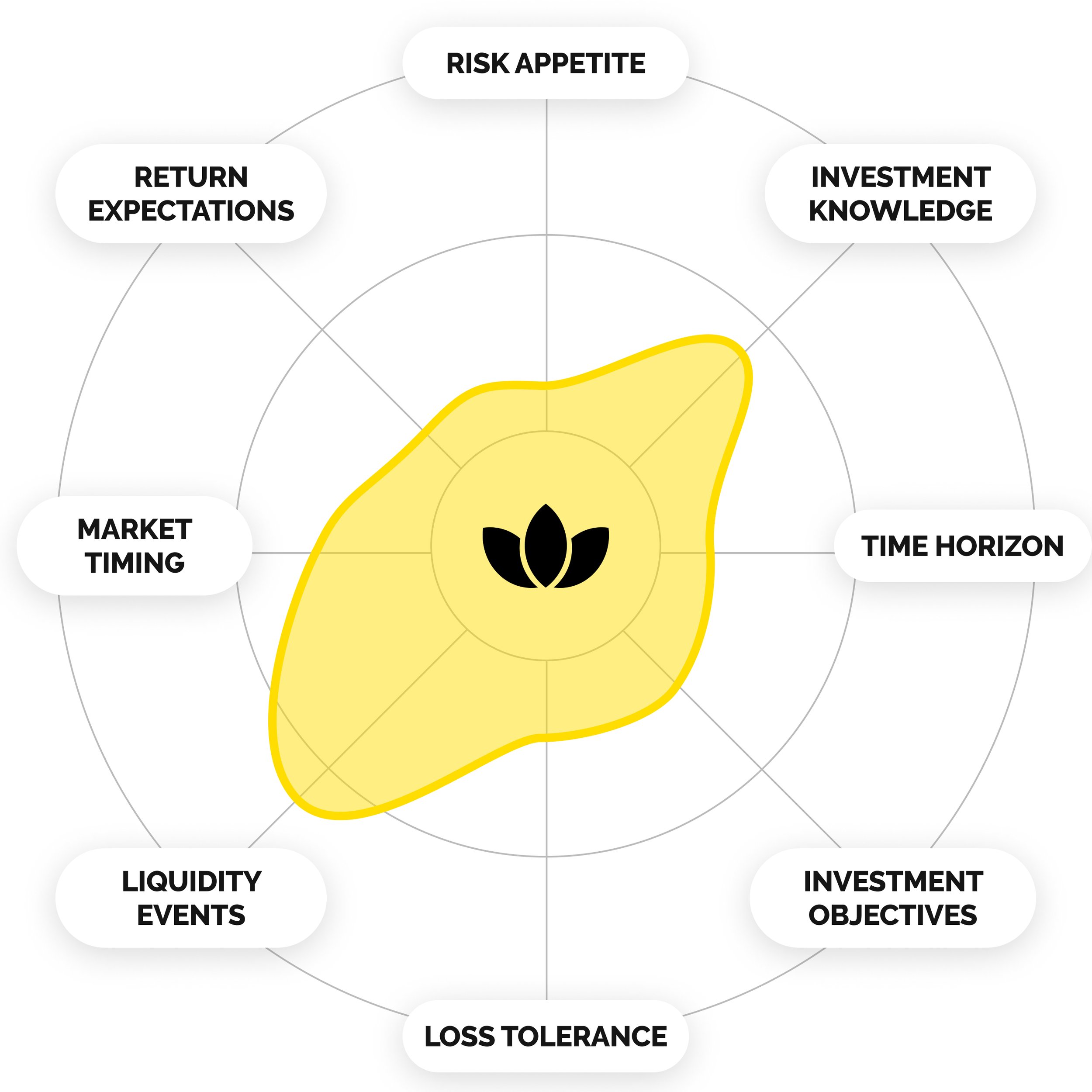

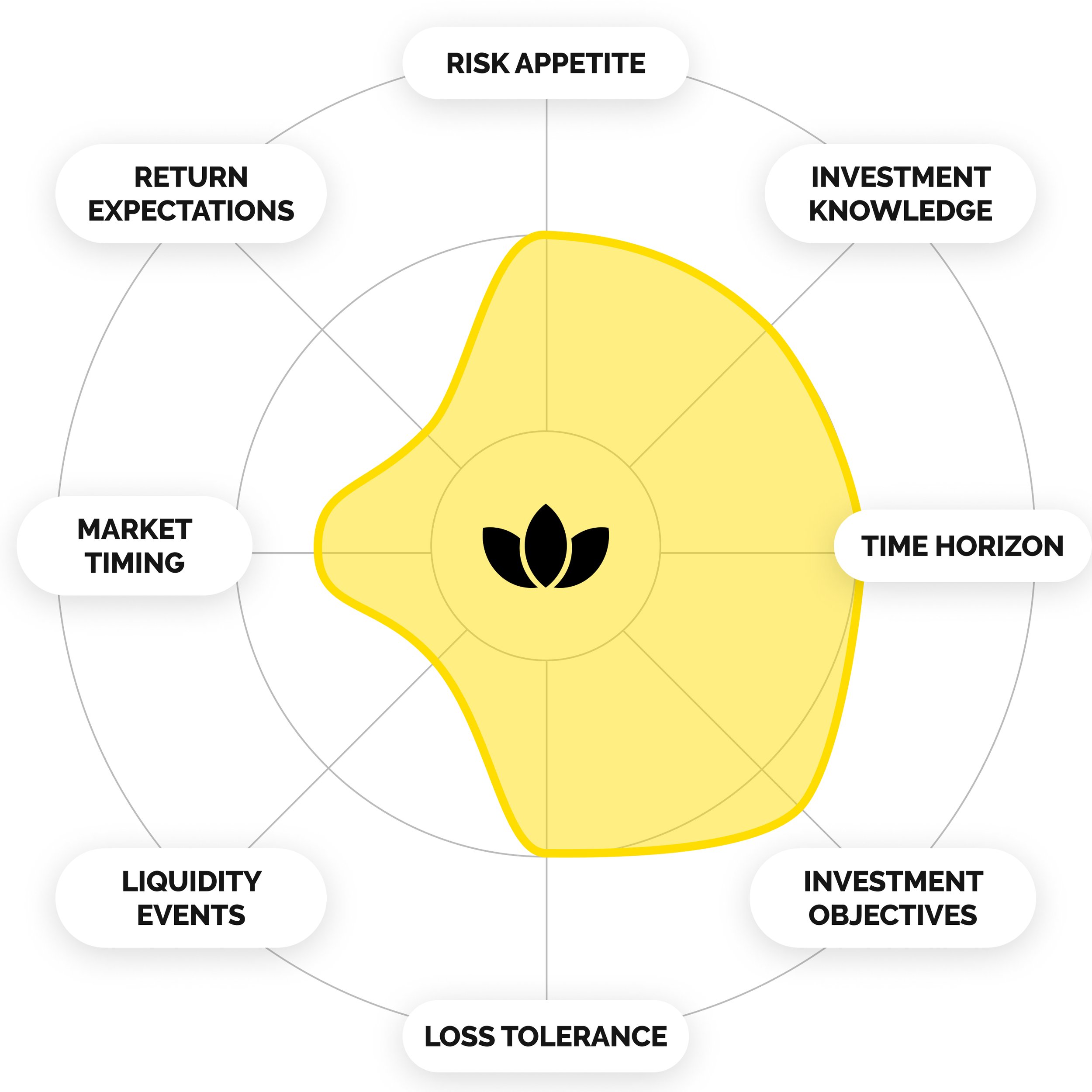

We use a set of disciplined rules to gain a 360-degree view of an asset’s behaviour in variable market conditions, allowing us to adopt a behavioural framework to our fund and security selection.

Our Preservation range is constructed using this framework, with a focus on protecting and growing our clients wealth whilst placing a strong focus on wealth preservation, avoiding irrecoverable losses along the way.

How do I start investing?

Investing with Spring is easy through our fully digital, online application. We ask you a few questions to find out what type of investor you are and match you with a globally diversified strategy that specifically meets your goals. No cumbersome paper forms and no need to post us anything. Interested in investing with us? Sign up here